Insurance fraud is a grave concern that affects insurers, policyholders, and society as a whole. Over the years, several high-profile insurance fraud cases have made headlines, captivating public interest and sparking conversations about the need for stronger measures to combat fraud. In this article, we will explore some of the most notorious insurance fraud cases that have been widely covered in the media. Let’s take a chronological journey through history to uncover when these cases occurred, the tactics employed by fraudsters, and the consequences of their actions on the insurance industry.

Table of Contents

Here is a list of top 10 insurance fraud cases that were in news for a longer time.

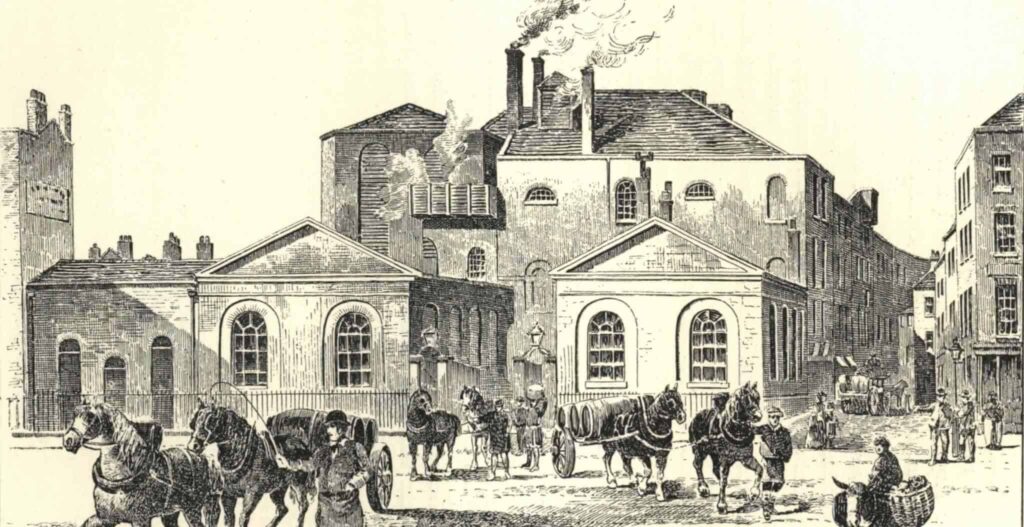

1. The London Beer Flood (1814): One of the Insurance Fraud Cases

Date: October 17, 1814

In a bizarre incident known as the “London Beer Flood,” a massive vat containing over 610,000 liters of beer burst open at the Meux and Company Brewery in London, flooding the streets with beer. While it might seem like an accident, there were suspicions that some individuals intentionally tampered with the vat to claim insurance for damages. However, there is no concrete evidence to support this theory.

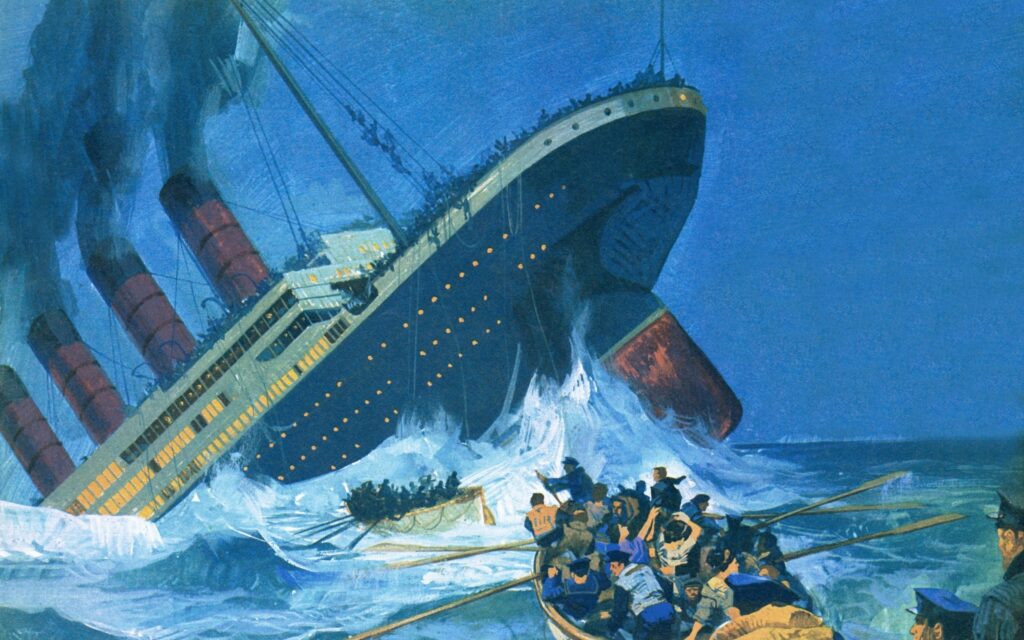

2. The Titanic Disaster (1912)

Date: April 15, 1912

The sinking of the RMS Titanic after striking an iceberg resulted in a devastating loss of lives and property. While most of the insurance claims were genuine, there were a few instances of fraud attempts. Some individuals tried to exaggerate the value of their belongings lost on the ship, leading to investigations and rejections of fraudulent claims. This was one of its own kind among all insurance fraud cases.

3. The Wine Connoisseur Scam (1930s)

Date: 1930s

We assume most of you would have heard about this among other insurance fraud cases. During the Prohibition era in the United States, wine collectors were allowed to keep a limited amount of alcohol for personal use. Taking advantage of this loophole, some individuals claimed to be wine connoisseurs and submitted fraudulent claims for wine damages, despite never having any wine in their possession. This led to a surge in fraudulent wine insurance claims.

4. The Great Fire of London (1666)

Date: September 2-6, 1666

The Great Fire of London was a devastating event that razed a significant portion of the city. In the aftermath, there were suspicions that some individuals deliberately set fires to their properties to claim insurance payouts. The chaotic nature of the fire made it challenging to investigate such claims thoroughly.

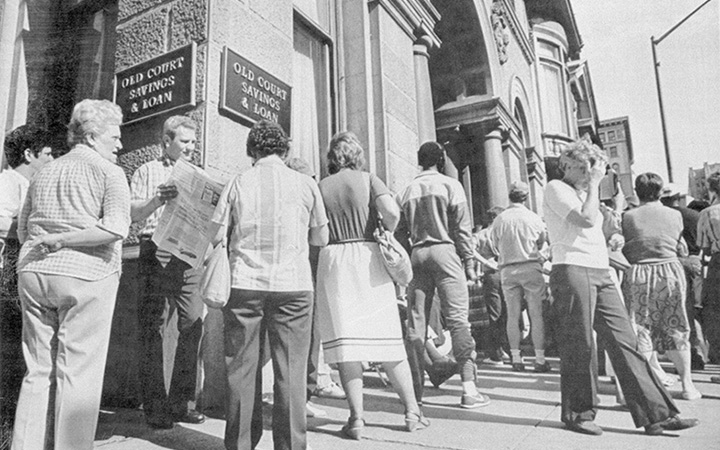

5. The United States Savings and Loan Crisis (1980s)

Date: 1980s

The United States Savings and Loan Crisis in the 1980s involved fraudulent activities by financial institutions, including misappropriation of funds and falsifying financial records. These fraudulent practices led to the collapse of several savings and loan associations, resulting in significant financial losses for both insurers and the public.

6. The Fraudulent Insurance Broker (2000s)

Date: Early 2000s

In this notorious case, an insurance broker sold fake insurance policies to unsuspecting clients, pocketing the premiums for personal use. When policyholders filed claims, they discovered they were not actually insured, leaving them in financial distress. These insurance fraud cases were because of the fraudulent broker. The fraudulent broker was eventually caught and prosecuted for his deceitful actions.

7. The Enron Scandal (2001)

Date: 2001

The Enron scandal involved accounting fraud and the manipulation of financial records to inflate the company’s stock value artificially. While this case primarily revolved around securities fraud, it also had significant implications for insurance companies that had provided coverage to Enron.

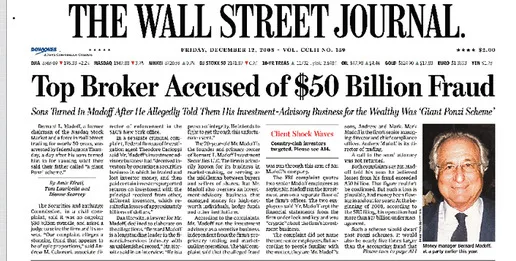

8. The Madoff Investment Scandal (2008)

Date: 2008

Bernard Madoff orchestrated one of the largest Ponzi schemes in history, defrauding thousands of investors of billions of dollars. This infamous case had repercussions for insurance companies that had provided coverage to the victims, leading to extensive legal battles and claims payouts.

9. The 2008 Financial Crisis

Date: 2008

The 2008 financial crisis was triggered by the collapse of the subprime mortgage market, which had widespread implications for the insurance industry. Some financial institutions engaged in fraudulent practices, contributing to the crisis and causing substantial losses for insurers.

10. The Deepwater Horizon Oil Spill (2010)

Date: April 20, 2010

The Deepwater Horizon oil spill in the Gulf of Mexico resulted in an environmental catastrophe. While most insurance claims were legitimate, there were a few attempts to inflate damages or submit fraudulent claims, leading to investigations and legal action.

Conclusion

Exploring notorious insurance fraud cases in the media takes us on a historical journey through some of the most infamous incidents that have left a lasting impact on the insurance industry. From ancient disasters to modern financial crises, fraudsters have continually attempted to exploit insurance policies for personal gain. While many cases have been exposed and perpetrators brought to justice, the battle against insurance fraud remains an ongoing challenge for insurers, regulators, and society at large. Vigilance, awareness, and robust preventive measures are essential in safeguarding the integrity of the insurance system and protecting policyholders from the consequences of fraudulent activities.

One thought on “Top 10 Famous Insurance Fraud Cases in the History of Mankind”

Your article helped me a lot, is there any more related content? Thanks!