Having a good credit score is crucial for financial stability and success. Your credit score plays a significant role in determining your eligibility for loans, credit cards, and even rental applications. In this comprehensive guide, we will explore the importance of a credit score, how it affects your financial life, and provide practical tips on how to improve your credit score.

The Importance of a Credit Score

Your credit score is a three-digit number that represents your creditworthiness. Lenders, landlords, and even potential employers use this score to assess your financial responsibility. A good credit score demonstrates that you are reliable and trustworthy when it comes to managing your finances.

When you have a good credit score, you are more likely to qualify for loans and credit cards with favorable terms and lower interest rates. On the other hand, a poor credit score can limit your financial opportunities and make it challenging to secure loans or obtain credit on favorable terms.

How Credit Score Affects Your Financial Life

Your credit score has a significant impact on various aspects of your financial life:

1. Loan Eligibility:

A higher credit score increases your chances of getting approved for loans, such as mortgages, car loans, or personal loans. Lenders consider your credit score to assess the risk of lending you money. A good credit score demonstrates that you are likely to repay the loan on time.

2. Interest Rates:

A good credit score can help you secure loans and credit cards with lower interest rates. With a lower interest rate, you can save money over the life of the loan and reduce your monthly payments.

3. Credit Card Applications:

Credit card companies evaluate your credit score when you apply for a new credit card. A higher credit score increases your chances of approval and may even qualify you for cards with better rewards and benefits.

4. Rental Applications:

Landlords often check credit scores as part of the rental application process. A good credit score can make it easier to secure a lease and may even result in lower security deposits.

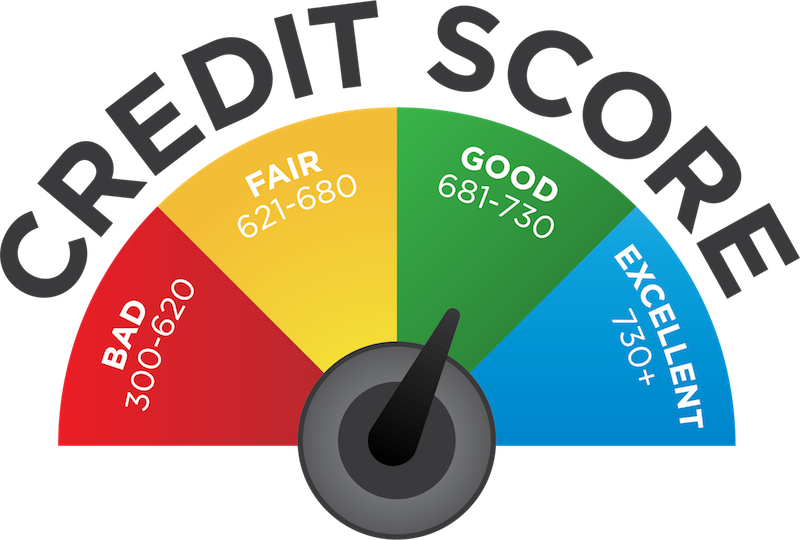

The Range of Credit Scores

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Here is a breakdown of the credit score ranges:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800-850

It’s important to note that different lenders may have slightly different criteria for evaluating credit scores. However, the general classification remains consistent.

Tips to Improve Your Credit Score

Improving your credit score takes time and effort, but the results are well worth it. Here are some practical steps you can take to improve your credit score:

1. Pay Your Bills on Time:

Consistently paying your bills on time is one of the most effective ways to improve your credit score. Late payments can have a significant negative impact on your score. Set up automatic payments or reminders to ensure you never miss a payment.

2. Reduce Your Credit Card Balances:

High credit card balances can negatively impact your credit score. Aim to keep your credit utilization ratio below 30%. Paying down your balances can help improve your score over time.

3. Avoid Opening Too Many New Accounts:

Opening multiple new credit accounts within a short period can raise concerns for lenders. It’s important to be selective and only apply for credit when necessary.

4. Regularly Check Your Credit Report:

Monitor your credit report for errors or inaccuracies. Dispute any incorrect information and work towards resolving any outstanding issues.

5. Maintain a Mix of Credit:

Having a diverse mix of credit, such as credit cards, loans, and mortgages, can positively impact your credit score. However, it’s essential to manage these accounts responsibly.

6. Be Patient:

Improving your credit score is a gradual process. It takes time to build a solid credit history and demonstrate responsible financial behavior. Stay consistent and patient, and you will see positive results over time.

By following these tips and making responsible financial decisions, you can improve your credit score and open doors to better financial opportunities. Remember, a good credit score is an investment in your future financial well-being.

2 thoughts on “The Ultimate Guide to Improving Your Credit Score”

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?