Welcome to another stock price prediction series by Moneypuller. In this article, we will present Lucid stock price predictions for 2024, 2025, 2026, 2030, 2040 and 2050. These predictions are based on market research done by a team of experts. Before delving into the details for Lucid stock forecast for coming years, let’s first understand what is Lucid Group and it’s business model?

What is Lucid Group?

Lucid Group, Inc., also widely known as Lucid motors is an American manufacturer company that designs, develops, and manufactures electric luxury vehicles and related technologies. Rivian, Toyota, Atlis and Ford are popular among close rivals of Lucid Motors. The company was founded in 2007 by former Tesla Motors VP Bernard Tse, co-founder of Astoria Networks Sam Weng and inventor Sheaupyng Lin and is headquartered in Newark, California. Lucid Group Inc. went public in July 2021 through a merger with Churchill Capital Corp IV, a special purpose acquisition company (SPAC).

Lucid Group, Inc trades under Lucid motors stock symbol/ticker of LCID on NASDAQ. Lucid launched its first electric vehicle in 2016 based on clean energy and named the vehicle as the “Lucid Air” which is offered in many trim level including the “Lucid Air Pure“.

Lucid (NASDAQ: LCID) Stock Price Predictions

There are many factors that can affect the company’s performance and valuation in future. However, based on the current trends and assumptions, we will share details on Lucid stock price predictions for the next 27 years, starting from 2024 to 2050. These predictions are close to actual assuming the current market trends.

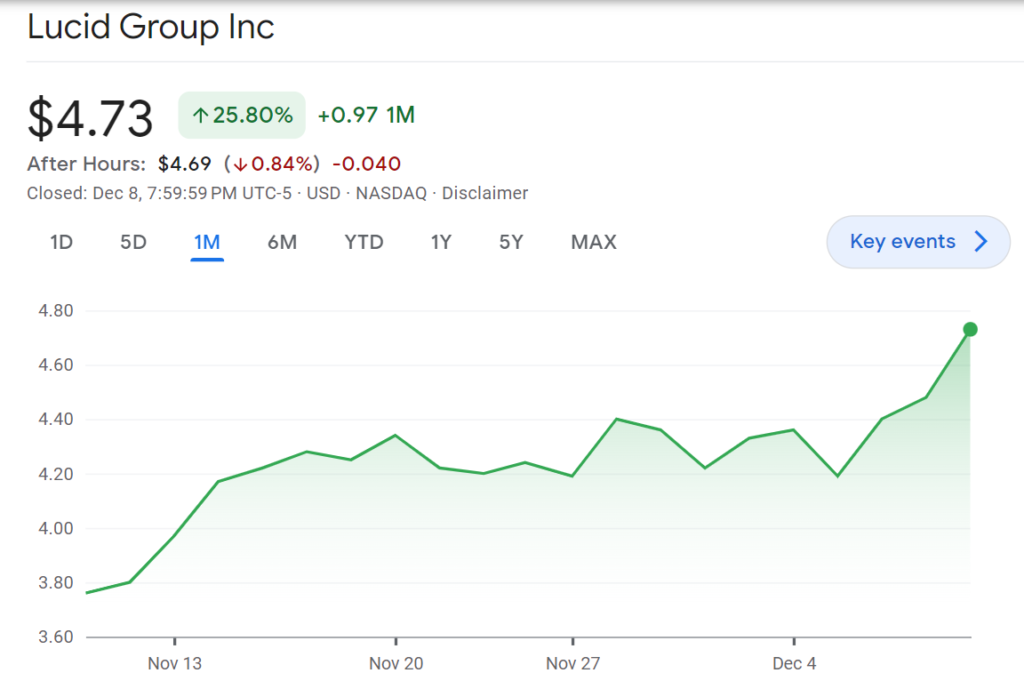

Just a heads up: Lucid stock has recovered by 25.80% and has shown a massive growth in just 1 month. The current Lucid Group Inc stock price is $4.73 as of 9th Dec’23.

Here is a summary of the Lucid stock price predictions done for coming 27 years (2024-2050) based on analysis done by a team of market experts. You can read about the detailed reasons behind these prediction in another sections of the article. Scroll down to check out complete details.

| Year | Lucid Stock Price Target |

|---|---|

| 2024 | $ 7 |

| 2025 | $ 11.25 |

| 2026 | $ 18.10 |

| 2027 | $ 27.54 |

| 2028 | $ 43.40 |

| 2029 | $ 62.65 |

| 2030 | $ 98.50 |

| 2035 | $ 325.70 |

| 2040 | $ 700.00 |

| 2045 | $ 1000.00 |

| 2050 | $ 1700.00 |

Lucid Stock Price Prediction 2024

The Lucid stock price prediction for 2024 is currently $7.00 assuming that the Lucid Group, Inc. shares will grow at the average yearly rate continuously as they performed since last 10 years.

Reasons to justify the Lucid stock forecast for 2024 and Lucid stock future for 2024:

Lucid Stock price targets and projections are based on the plans of the company in general. The Lucid Group, Inc. company is planning to deliver around 78,000 vehicles in 2024 which will generate about $5.4 billion in revenue. However, the company is still expected to face competition from other popular EV makers like Tesla, Rivian, Polestar, Apple, Nikola, and Mullen Automotive.

The company will also have to invest heavily in expanding its production capacity, scaling the business, building its charging network, and developing new models and technologies. Therefore, the company will likely continue to report negative earnings and cash flow in 2024. Based on the average analyst price target of $6.55 as per the market analysis, which implies a forward price-to-sales ratio of 1.2, the stock price of Lucid Group could reach around $7.00 by the end of 2024, representing around 48% increase from the current price of $4.73.

Also Check: Rivian (RIVN) Stock Price Prediction from 2024 to 2050

Lucid Stock Price Prediction 2025

The Lucid Group, Inc. stock predictions for 2025 currently is $ 11.25. assuming that the demand of the Lucid Group’s luxury SUV segment would increase as the Lucid Group is expected to launch its second model alike the Lucid Gravity, a luxury SUV, in 2025.

Reason to justify the Lucid stock forecast for 2025 and Lucid stock future for 2025:

The company hopes to tap into the growing demand for SUVs, especially in the US and China markets.

The company is also planning to enter the European market as well in 2025, where it will face more regulatory and environmental challenges, such as the availability of charging infrastructure, battery supply, and emission standards.

The company could deliver around 117,000 vehicles in 2025, generating about $8.1 billion in revenue. However, the company will still face margin pressure from the EV price war, as well as rising costs of raw materials, labor, and transportation. The company will also need to raise more capital to fund its growth plans, which could dilute the existing shareholders. Based on a forward price-to-sales ratio, the stock price of Lucid Group could reach around $11.25 by the end of 2025.

Lucid Stock Price Prediction 2026

Lucid (LCID) stock price prediction for 2026 is $18.10.

Lucid Group is expected to achieve positive EBITDA and free cash flow in 2026, according to its own projections.

Reasons to justify the Lucid stock forecast for 2026 and Lucid stock future for 2026:

The company could deliver around 156,000 vehicles in 2026, generating about $10.8 billion in revenue. The company will benefit from the economies of scale, operational efficiency, and brand recognition. The company will also leverage its technological advantages, such as its proprietary battery and powertrain system, which claims to offer the highest energy density and range in the industry.

The company will also introduce more affordable models alike Lucid Air Pure, which has a starting price of $69,900. The company will also expand its product portfolio to include more segments, such as sports cars, commercial vehicles, and autonomous vehicles. Based on a forward price-to-sales ratio, the stock price of Lucid Group could reach around $18.10 by the end of 2026.

Lucid Stock Price Prediction 2027

According to Lucid stock projections and analysis, Lucid stock price prediction for 2027 is $27.54 assuming that it maintains its current 10-year average growth rate.

Reasons to justify the Lucid stock predictions for 2027 and Lucid stock future for 2027:

Lucid Group is expected to become profitable and pay its first dividend in 2027, according to its own projections. The company could deliver around 195,000 vehicles in 2027, generating about $13.5 billion in revenue. The company may enjoy a loyal customer base, a strong brand image, and a premium pricing power.

The company is also expected to get benefit from the increasing adoption of electric vehicles, as more consumers and governments become aware of the environmental and economic benefits of switching from fossil fuels to renewable energy sources. The company will also partner with other companies and organizations, such as ride-hailing services, car-sharing platforms, and smart city initiatives, to offer more mobility solutions and services. Based on a forward price-to-sales ratio, the stock price of Lucid Group could reach around $27.54 by the end of 2027.

Lucid Stock Price Prediction 2030

Lucid stock price prediction for 2030 is $98.50.

In 2030, the Lucid Group, Inc. stock (NASDAQ: LCID) will reach $98.50 if it continues to grow at the average yearly rate as it did in last 10 years historically.

Reasons to justify the Lucid motors stock forecast for 2030 and Lucid stock future for 2030:

Lucid Group is expected to maintain its growth momentum and profitability in the next three years, as it continues to innovate and expand its market share. The company could deliver around 234,000 vehicles in 2028, 273,000 vehicles in 2029, and 312,000 vehicles in 2030, generating about $16.2 billion, $18.9 billion, and $21.6 billion in revenue, respectively. The company will also increase its dividend payout ratio, rewarding its shareholders with higher returns.

The company may also explore new opportunities and challenges, such as the development of hydrogen fuel cell vehicles, the integration of artificial intelligence and blockchain, and the emergence of new competitors and regulations.

Based on a forward price-to-sales ratio, the stock price of Lucid Group could reach around $98.5 by the end of 2030.

Lucid Stock Price Prediction 2035

As per LCID stock analysis, the Lucid stock forecast for 2035 is $325.70.The Lucid Group is expected to face some headwinds and slowdowns in the past five years, as it might reach a mature stage in its growth cycle.

Reasons to justify the Lucid Stock Price Prediction 2035 and Lucid stock future for 2035:

The company could deliver around 351,000 vehicles in 2031, 390,000 vehicles in 2032, 429,000 vehicles in 2033, 468,000 vehicles in 2034, and 507,000 vehicles in 2035, generating about $24.3 billion, $27.0 billion, $29.7 billion, $32.4 billion, and $35.1 billion in revenue, respectively. The company will face more competition and saturation in the EV market, as well as more disruptions and uncertainties from the global economic and political environment.

The company will also need to invest more in R&D and innovation, as well as in social and environmental responsibility, to maintain its competitive edge and reputation. Based on a forward price-to-sales ratio, the stock price of Lucid Group (LCID) could reach around $325.70 by the end of 2035.

Lucid Stock Price Prediction 2040

According to the market research and LCID/ Lucid stock projections, the Lucid stock price prediction for 2040 is $700.00. Lucid Group is expected to enter a stable and steady phase in the last five years from 2035 to 2040, as it consolidates its position and diversifies its revenue streams.

Reasons to justify the Lucid Stock Price Prediction 2040 and Lucid stock future for 2040:

The company could deliver around 546,000 vehicles in 2036, 585,000 vehicles in 2037, 624,000 vehicles in 2038, 663,000 vehicles in 2039, and 702,000 vehicles in 2040, generating about $37.8 billion, $40.5 billion, $43.2 billion, $45.9 billion, and $48.6 billion in revenue, respectively.

The company will focus more on customer retention, loyalty, and satisfaction, as well as on enhancing its brand value and quality. The company will also generate more revenue from its services and solutions, such as charging, maintenance, software, data, and mobility. The company will also participate in more mergers and acquisitions, alliances and partnerships, and joint ventures and collaborations, to expand its global presence and influence. Based on a forward price-to-sales ratio, the stock price of Lucid Group could reach around $700.00 by the end of 2040.

Lucid Stock Price Prediction 2045

Lucid Stock Price Prediction for 2045 is $1000.00 keeping in view of simple moving average of the yearly growth and Lucid stocks past 10 years performance.

Reasons to justify the Lucid Stock Price Prediction 2045 and Lucid stock future for 2045:

Lucid Group is expected to face some headwinds and slowdowns in 2045, as it reaches a mature stage in its growth cycle. The company could deliver around 1,200,000 vehicles in 2045, generating about $83.5 billion in revenue. The company will face more competition and saturation in the EV market, as well as more disruptions and uncertainties from the global economic and political environment. The company will also need to invest more in R&D and innovation, as well as in social and environmental responsibility, to maintain its competitive edge and reputation. Based on a forward price-to-sales ratio, the stock price of Lucid Group (LCID) could reach around $1000.00 by the end of 2045.

Lucid Stock Price Prediction 2050

The Lucid group EVs market performance and like wise the LCID stock price depends on many uncontrollable factors.

As per market experts and the stock analysis, the Lucid stock price prediction for 2050 is $1700, crossing $1500 mark.

Reasons to justify the Lucid Stock Price Prediction 2050 and Lucid stock future for 2050:

Lucid Group is expected to enter a stable and steady phase in the last five years (2045-2050), as it consolidates its position and diversifies its revenue streams.

The company could deliver around 1,300,000 vehicles in 2046, 1,400,000 vehicles in 2047, 1,500,000 vehicles in 2048, 1,600,000 vehicles in 2049, and 1,700,000 vehicles in 2050, generating about $90.5 billion, $97.5 billion, $104.5 billion, $111.5 billion, and $118.5 billion in revenue, respectively.

The company will focus more on customer retention, loyalty, and satisfaction, as well as on enhancing its brand value and quality. The company will also generate more revenue from its services and solutions, such as charging, maintenance, software, data, and mobility.

The company will also participate in more mergers and acquisitions, alliances and partnerships, and joint ventures and collaborations, to expand its global presence and influence. Based on a forward price-to-sales ratio, the stock price of Lucid Group could reach around $1700.00 by the end of 2050.

People Also Ask For:

What is the Lucid Group, Inc. stock forecast?

According to stock market analysis done by a team of experts, the Lucid Group, Inc. stock forecast for future years are as follows:

- Lucid stock price prediction 2024 is $7.00

- Lucid stock price prediction 2025 is $11.25

- Lucid stock price prediction 2026 is $18.10

- Lucid motors stock prediction 2030 is $98.50

- Lucid stock price prediction 2035 is $325.70

- Lucid stock price prediction 2040 is $700.00

- Lucid stock price prediction 2045 is $1000.00

- Lucid motors stock forecast 2050 is $1700

What is the Lucid Group, Inc. stock prediction for 2025?

The Lucid Group, Inc. stock predictions for 2025 currently is $ 11.25. assuming that the demand of the Lucid Group’s luxury SUV segment would increase as the Lucid Group is expected to launch its second model, the Lucid Gravity, a luxury SUV, in 2025.

What is the Lucid Group, Inc. stock prediction for 2030?

Lucid stock price prediction for 2030 is $98.50.

In 2030, the Lucid Group, Inc. stock (NASDAQ: LCID) will reach $98.50 if it continues to grow at the average yearly rate as it did in last 10 years historically.

What will lucid stock be worth in 5 years?

According to Lucid stock price forecast, LCID stock in another 5 years say 2030 may be priced at an average stock price of $98.50.

Lucid stock price prediction for 2030 is $98.50.

In 2030, the Lucid Group, Inc. stock (NASDAQ: LCID) will reach $98.50 if it continues to grow at the average yearly rate as it did in last 10 years historically.

What will lucid stock be worth in 10 years

In another 10 years, Lucid (LCID) stock price may go around $325.7. If Lucid is able to crack the competition and generate higher demand for its luxury EV car segment, the stock price can even go higher.

Will Lucid Group, Inc. stock reach $100?

Yes, Lucid stock price is expected to reach $100 by 2030 based on current market trends and lucid stock outlook.

Will Lucid Group, Inc. stock reach $500?

Yes, Lucid Group, Inc, stock is expected to reach $500 by 2038. Lucid stock projections right now shows bullish angle in future. If Lucid Group is successful in targeting customers and generating demand consider other competitors like Tesla, Rivian etc. in the electric vehicle segment.

Will Lucid Group, Inc. stock reach $1,000?

Yes, Lucid Group, Inc. stock price may reach $1000 stock price target by 2045 based on current trend and past 10 years simple moving average growth.

Is Lucid Group, Inc. a good stock to buy?

As per current market situation and our Lucid Group, Inc. stock forecast, Lucid stock is a good stock to buy as the Lucid stock price may significantly grow in coming years.

What’s the Lucid Group, Inc. stock price prediction for tomorrow?

The Lucid Group, Inc. stock price prediction for tomorrow is $ 4.98, based on the existing market trends. According to our stock predictions, the price of LCID stock will increase by 5% in the next day.

What’s the Lucid Group, Inc. stock price prediction for next week?

As per stock market experts, the Lucid Group, Inc. stock price prediction for next week is $ 4.65, which would represent a drop of -3.28% in the LCID current stock price.

Will Lucid Group, Inc. stock go up tomorrow?

As per our LCID stock prediction, Lucid stock will go up tomorrow. Based on the current market trends, our stock prediction says that the price of LCID stock will grow by 3.15% in the next day.

Will Lucid Group, Inc. stock go down tomorrow?

As per our LCID stock prediction, Lucid stock will not go down tomorrow. Based on the current market trends, our stock prediction says that the price of LCID stock will grow by 3.15% in the next day.

How to read and forecast Lucid Group, Inc. stock price movements?

Lucid Group, Inc. stock traders employ a range of methods to forecast where the LCID market will go next. These tools are broadly classified as indicators and chart patterns. When making a Lucid Group, Inc. stock forecast, traders look for critical support and resistance levels, which might indicate when a downtrend is expected to halt and an uptrend is likely to stall.

Lucid Group, Inc. Stock Forecast Indicators

Moving averages are one of the most often used Lucid Group, Inc. stock forecasting methods. A moving average, as the name implies, offers the average closing price for LCID stock over a certain time frame, which is divided into a number of equal-length periods. A 12-day simple moving average for LCID, for example, is the total of LCID’s closing prices over the past 12 days divided by 12.

Along with the simple moving average (SMA), traders employ another moving average method known as the exponential moving average (EMA). The EMA gives higher importance to current prices and hence reacts more swiftly to price changes.

Moving averages of 50, 100, and 200 days are among the most often utilized indicators in the stock market for identifying critical resistance and support levels. If the Lucid Group, Inc. stock price rises above any of the above averages, it is considered a positive indicator for the Lucid Group, Inc. stock. A dip below an important moving average, on the other hand, is typically seen as a bearish outlook for the LCID market. Traders often prefer to use the RSI and Fibonacci retracement level indicators to predict the direction of the Lucid Group, Inc. stock price in the future.

How to read Lucid Group, Inc. stock charts and forecast price movements?

Most traders use candlestick charts to forecast Lucid Group, Inc. stock because they give more information than a conventional line chart. Traders may observe candlesticks that depict the price activity of Lucid Group, Inc. stock at various granularities, such as a 5-minute candlestick chart for extremely short-term price action or a weekly candlestick chart to discover long-term patterns.

The most common candlestick charts are 1-hour, 4-hour, and 1-day. Let’s look at a 1-hour candlestick chart to see how this style of price chart may tell us about starting and closing values. The chart is separated into “candles” that provide 1-hour chunks of information regarding Lucid Group, Inc.’s stock price activity. Each candlestick will show the starting and closing prices of LCID, as well as the maximum and lowest prices attained by Lucid Group, Inc. throughout the 1-hour period. This data makes it easy to create an educated price estimate.

It’s also vital to consider the candle’s color: a green candle indicates that the closing price was greater than the beginning price, whilst a red candle indicates the reverse. To show the same phenomenon, other charts will utilize hollow and full candlestick bodies instead of colors.

What affects the price of LCID stock?

The price of Lucid Group, Inc. shares, like any other asset, is determined by supply and demand. Fundamental reasons like as earnings releases, new product launches, acquisitions and mergers, and other factors can all have an impact on these dynamics. Market mood, broader economic circumstances, interest rates, inflation rates, and political happenings can all have an impact on the LCID stock price.

Bullish and bearish stock price forecast patterns

To get an advantage over the competition, some traders attempt to detect candlestick patterns while making stock price predictions. Some candlestick forms are thought to predict bullish market activity, while others are thought to predict negative price action.

Some of the most popular bullish candlestick patterns are:

- Hammer

- Bullish Engulfing

- Piercing Line

- Three White Soldiers

- Morning Star

Some common bearish candlestick patterns are:

- Bearish Harami

- Shooting Star

- Evening Star

- Hanging Man

- Dark Cloud Cover

Good Read: Rivian (RIVN) Stock Price Prediction from 2024 to 2050

Disclaimer:

Please note that these are only hypothetical projections and not investment advice. You should do your own research and consult a professional before making any financial decisions.