If you’ve ever applied for a loan, credit card, or lease, you know that lenders check your credit score before making a decision. But do you really understand how credit scores are calculated? And why does accuracy matter? In this blog post, we’ll dive deep into the world of credit scores, how to calculate credit scores, exploring every aspect of how they’re calculated and why it’s critical to ensure that your credit report is accurate and up-to-date.

Table of Contents

What Is a Credit Score?

Before we jump into the nitty-gritty details of how credit scores are calculated, let’s start with the basics.

A credit score is a numerical representation of an individual’s creditworthiness, calculated based on their credit report. It is a three-digit number that represents your creditworthiness. It’s designed to help lenders predict the likelihood that you’ll repay a loan or credit obligation on time. It helps lenders to determine an individual’s eligibility for credit, the interest rate they will be charged, and the overall terms of the loan. In this blog post, we will explore how credit scores are calculated, what factors contribute to them, and why understanding these calculations is important for individuals looking to build or repair their credit.

Lenders use credit scores to decide whether to extend credit to you, and if so, at what interest rate and under what terms. So, if you want to buy a house, get a car loan, or even rent an apartment, your credit score plays a big role in determining your options and costs.

How to Calculate Credit Scores?

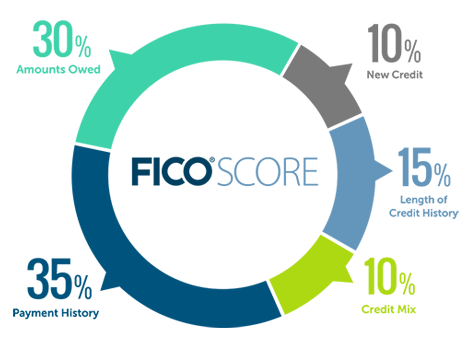

So, how is a credit score actually calculated? The most commonly used credit scoring model in the United States is the FICO score, which ranges from 300 to 850 and is widely used to calculate credit scores globally.

The FICO score is calculated based on information in your credit report, which contains information about your credit history, including:

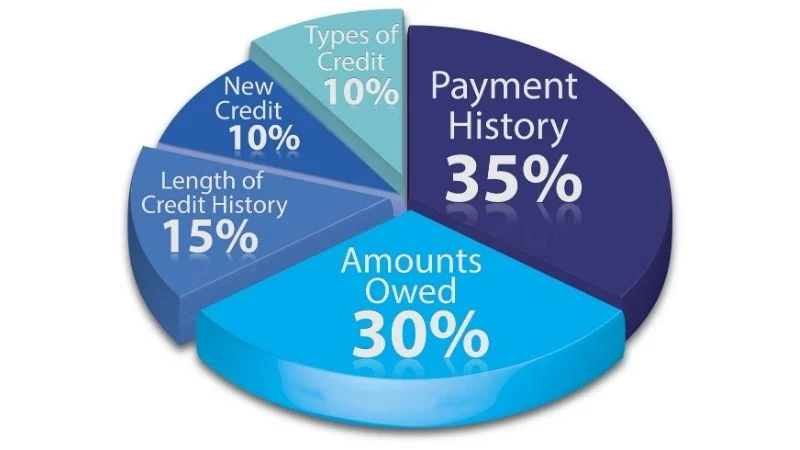

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Types of credit used (10%)

- New credit (10%)

Here’s a closer look at each of these factors and how they’re used in calculating your credit score:

Payment History:

This section of your credit report shows whether you’ve made your payments on time, and if not, how late you were. Late payments can hurt your credit score, while on-time payments can help boost it.

Credit Utilization:

Your credit utilization ratio measures how much of your available credit you’re using. Keeping this ratio low (less than 30%) helps show lenders you can manage your debt responsibly.

Length of Credit History:

Having a longer credit history indicates you’ve been managing credit responsibly for a longer period, which can increase your credit score.

Types of Credit Used:

Using a mix of different types of credit (such as credit cards, loans, and mortgages) demonstrates responsible credit behavior and can help boost your score.

New Credit:

Applying for too many new credit products in a short period can trigger a negative response from lenders, as it might suggest you’re taking on too much debt.

Calculating Credit Score

The most widely used credit scoring model is the FICO score, developed by Fair Isaac Corporation. There are two main versions of the FICO score: FICO 8 and FICO 9. Both of these credit score models are used to calculate credit scores. The difference between the two lies in the way they handle public record information.

FICO 8 assigns a weighted value to each of the five categories mentioned above, ranging from 1-10. Each category has its own set of subcategories, and each subcategory is assigned a specific point value. The points are then added up to give an individual’s total FICO score.

For example, if an individual has excellent payment history, with no late payments or delinquencies, they would earn a high score in the “payment history” category. If they also have a low credit utilization rate, meaning they are not using a large portion of their available credit, they would also earn a high score in the “credit utilization” category. By adding up the points earned in each category, an individual’s total FICO score is determined.

On the other hand, FICO 9 gives more weight to the “new credit” category, which means that applying for too many new credits in a short period of time can negatively affect an individual’s credit score. Additionally, FICO 9 considers the “credit mix” category more heavily, taking into account the balance across different types of credit.

Other credit scoring models, such as VantageScore, use similar methods to calculate credit scores, but with slightly different weights and formulas.

Factors Contributing to Credit Scores

There are several factors that contribute to an individual’s credit score. These include:

- Payment History: This category represents 35% of an individual’s credit score and is based on their past payment behavior. Factors included in this category include timely payments, missed payments, and the percentage of total debt paid.

- Credit Utilization: This category represents 30% of an individual’s credit score and is based on the amount of credit being used compared to the amount of credit available. It is best to keep this ratio below 30%.

- Length of Credit History: This category represents 15% of an individual’s credit score and is based on the length of time since the first credit account was opened. Longer credit histories tend to result in higher credit scores.

- Types of Credit Used: This category represents 10% of an individual’s credit score and is based on the diversity of credit types held by the individual. For example, having both a mortgage and a car loan would provide a better score than only having one type of credit.

- New Credit: This category represents 10% of an individual’s credit score and is based on recent changes to an individual’s credit profile, such as applying for new credit or closing old accounts. Applying for too many new credits in a short period of time could negatively affect an individual’s credit score.

- Credit Mix: This category represents 10% of an individual’s credit score and is based on the balance across various types of credit. It is best to maintain a healthy balance between different types of credit.

- New Addresses: This category represents 2% of an individual’s credit score and is based on the frequency of address changes reported to the credit bureaus. Too frequent address changes could negatively affect an individual’s credit score.

- Employment History: This category represents 2% of an individual’s credit score and is based on employment status and tenure. Stable employment tends to result in higher credit scores.

- Public Records: This category represents 1% of an individual’s credit score and is based on public records such as bankruptcies, foreclosures, and tax liens. Presence of these records can significantly lower an individual’s credit score.

Why Does Accuracy Matter?

While the exact algorithm used to calculate credit scores varies depending on the issuer, there are certain key elements that must be present in order for a credit score to be valid. These include:

- Identity Information: Your name, Social Security number, date of birth, and other identifying information should match the information provided during the application process.

- Account Information: All accounts listed on your credit report should be accurate and current. Outdated or incorrect information can negatively impact your credit score.

- Payment History: Your payment history should accurately reflect your actual payment behavior. Missed or late payments can harm your credit score, while on-time payments can help improve it.

Why Should I Check My Credit Report?

Checking your credit report regularly is essential to ensuring that your credit score is accurate and up-to-date. When you request a copy of your credit report, you’ll receive a free copy of your credit file, which includes information from all three major credit reporting agencies – Equifax, Experian, and TransUnion.

By reviewing your credit report, you can identify errors or discrepancies that need to be corrected. This can involve disputing errors with the credit reporting agency or working with the creditor to resolve issues like unpaid debts or incorrect account information.

Tips for Improving Your Credit Score

Now that you know how credit scores are calculated and why accuracy matters, here are some tips to help you improve yours:

- Make on-time payments: Pay your bills on time, every time. Set up automatic payments or reminders to ensure you never miss a payment.

- Keep credit utilization low: Aim to use less than 30% of your available credit to show lenders you can manage your debt responsibly.

- Monitor your credit report: Request a free credit report from each of the three major credit reporting agencies once a year to spot errors or discrepancies.

- Don’t open too many new credit accounts: Only apply for credit when necessary, and space out applications to avoid triggering a negative response from lenders.

Impact of Credit Score on Financial Decisions

An individual’s credit score plays a significant role in determining their ability to secure credit and the terms of that credit. Here are some ways in which credit score can impact financial decisions:

- Loan Approval: Banks and other lenders use credit scores to evaluate an individual’s creditworthiness before approving a loan application. Individuals with higher credit scores are often approved for larger amounts of credit at lower interest rates.

- Interest Rates: An individual’s credit score can influence the interest rate they qualify for. Higher credit scores usually lead to lower interest rates, while lower credit scores result in higher interest rates.

- Credit Card Limits: Credit card issuers use credit scores to determine an individual’s credit limit. Those with higher credit scores are offered higher limits, while those with lower credit scores are limited to smaller spending limits.

- Mortgage Eligibility: Real estate agents and lenders use credit scores to assess an individual’s eligibility for a mortgage. Good credit scores make it easier to get preapproved for a mortgage and negotiate favorable terms.

- Car Loans: Dealerships and finance companies use credit scores to determine an individual’s eligibility for auto financing. Good credit scores allow individuals to qualify for better interest rates and terms.

Good Read:

Credit Scoring Models: A Comprehensive Guide

The Ultimate Guide to Improving Your Credit Score

Conclusion:

Understanding how credit scores are calculated and why accuracy matters is essential for anyone who wants to maintain a positive credit history. By checking your credit report regularly and following best practices for managing your debt, you can help ensure that your credit score stays healthy and continues to grow over time. Remember, a good credit score isn’t just important for buying a home or car; it can also help you save money on insurance premiums and even land a job!

One thought on “How to Calculate Credit Scores: Everything You Need to Know”