When it comes to personal finance, saving money is one of the most important habits you can develop. Whether you’re saving for a specific goal or building an emergency fund, knowing how much to save each month can be a bit overwhelming. But fear not! In this guide, we’ll break it down for you in a simple and easy-to-understand way, complete with examples to help you get started on the right track.

Step 1: Assess Your Financial Goals

The first step in determining how much you should save each month is to assess your financial goals. Are you saving for a down payment on a house? Planning for a dream vacation? Or maybe you want to build an emergency fund to cover unexpected expenses. Whatever your goals may be, it’s important to have a clear idea of what you’re saving for.

Let’s say you’re saving for a down payment on a house and you want to save $50,000 in five years. To achieve this, you’ll need to save $10,000 per year or approximately $833 per month. Breaking it down into smaller, manageable goals makes it easier to stay motivated and track your progress.

Step 2: Calculate Your Monthly Expenses

Before you can determine how much you should save each month, it’s crucial to have a good understanding of your monthly expenses. Take some time to review your bank statements, bills, and receipts to get an accurate picture of where your money is going.

Let’s say your monthly expenses amount to $3,000. This includes rent, utilities, groceries, transportation, and other essential costs. Now, subtract your monthly expenses from your income to determine how much you have left to save.

If your monthly income is $4,000 and your expenses are $3,000, you have $1,000 left over. This is the amount you can allocate towards savings each month.

Step 3: Set a Realistic Savings Target

Once you know how much you have left to save each month, it’s time to set a realistic savings target. While it’s great to save as much as possible, it’s important to be practical and consider your current financial situation.

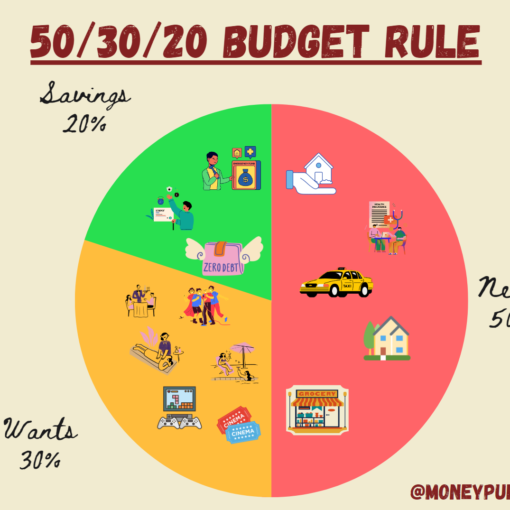

A general rule of thumb is to save at least 20% of your monthly income. In our example, if you have $1,000 left over each month, you should aim to save $200 (20% of $1,000).

However, if you have other financial obligations or debt to pay off, you may need to adjust your savings target accordingly. It’s crucial to strike a balance between saving for the future and meeting your current financial needs.

Step 4: Automate Your Savings

Now that you know how much you should save each month, it’s time to make it a habit. One of the best ways to ensure consistent savings is to automate the process.

Set up an automatic transfer from your checking account to a separate savings account on the day you receive your paycheck. By doing this, you won’t have to rely on willpower alone to save. It becomes a routine, and you’re less likely to spend the money before you have a chance to save it.

Step 5: Adjust and Reevaluate

As your financial situation changes, it’s essential to adjust and reevaluate your savings strategy. Life is full of surprises, and your savings goals may evolve over time.

If you receive a raise or a bonus, consider increasing your monthly savings contributions. On the other hand, if you encounter unexpected expenses or a decrease in income, you may need to temporarily reduce your savings amount.

Remember, saving money is a long-term commitment. It’s okay to make adjustments along the way as long as you stay focused on your overall financial goals.

Conclusion

Determining how much you should save each month is a personal decision influenced by your financial goals, monthly expenses, and current financial situation. By assessing your goals, calculating your expenses, setting a realistic savings target, automating your savings, and adjusting as needed, you’ll be well on your way to achieving financial security.

Remember, saving money is not about depriving yourself of the things you love. It’s about making conscious choices, prioritizing your future, and creating a solid foundation for financial well-being. So start saving today and watch your savings grow!